Real Estate Roundup

Welcome to another edition of Real Estate Roundup, a monthly newsletter that provides insider access to private real estate’s latest trends, brightest minds, and top investment ideas.

Read by family offices, high-net-worth individuals and wealth managers, The Private Investor is a go-to resource for investors all over the country.

This newsletter is a 5-minute read.

Renowned Real Estate Economist Reveals His Predictions

When Dr. Peter Linneman talks, industry professionals listen closely. The popular real estate economist recently gave a one-hour interview where he shared his opinions on a wide range of top-of-mind subjects.

The whole interview is worth a listen. Here are a few of the key takeaways:

What’s next for office leasing? Linneman explains how historically there was a clear positive correlation between net job growth and positive absorption for office space. More jobs meant more need for office space and vice versa. However, this correlation turned modestly negative over the past three years as more companies allowed their employees to work remotely. While many are predicting the end of office, Linneman believes the recent trend will revert back to a positive correlation where strong job growth results in a strong need for office space.

Who will benefit from office’s pain? While Linneman is more bullish on office than most, he recognizes risk averse investors are unlikely to allocate to the asset class for the foreseeable future. As a result, he expects investors who are overweight in office to significantly trim their exposure, which will free up massive amounts of capital for other uses. He expects this capital will find its way into in-demand sectors like industrial and multifamily. Office’s pain and is another’s gain.

Is it possible to determine cap rates today? Linneman argues it’s very difficult to determine cap rates in the private market due to transaction volumes being down significantly over the past year. In multifamily, for example, volume has decreased more than 80%. Of the ~20% that did trade, he doesn’t think it make sense to consider the cap rates as “market cap rates” since they only reflect ~20% of normal activity. He believes the ~80% that didn’t transact are essentially saying they don’t believe the “market cap rates” are accurate or else they would be trading too. As a result, participants should be wary of stated “market cap rates”.

Industrial Construction Activity Hits Post-Pandemic Low

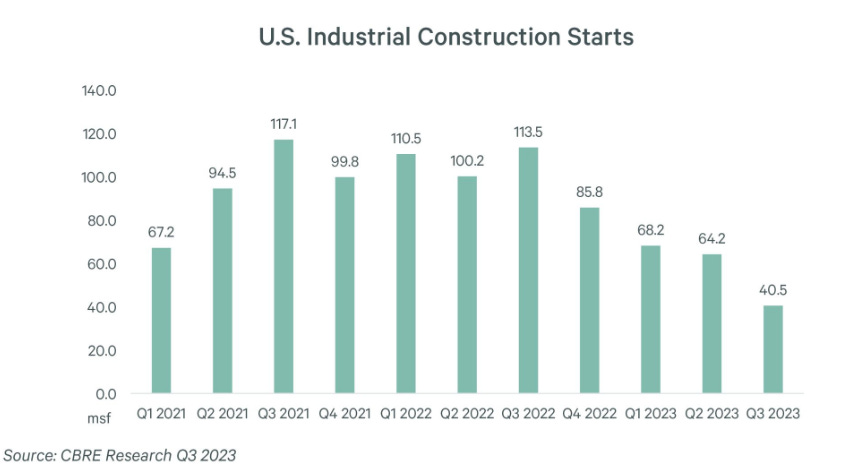

According to a recent chart shared by James Breeze, the Global Head of Industrial & Logistics Research at CBRE, construction starts declined to a post-pandemic low of 40.5 million square feet in Q3 2023.

While the U.S. vacancy rate continues to sit below historical averages, it has ticked up to 4.2% as a result of record construction completions in 2023, plus the normalization of user demand from record highs. However, Breeze expects completions in 2024 to be half the total of 2023 as developers continue to struggle to secure financing. He also predicts the significant decline in construction next year could lead to an under supply of first-generation space by early 2025, causing vacancy rates to go down again.

The Long Wait for Distressed Investment Opportunities Is Over

For more than a decade, investors around the globe have been patiently waiting to pounce on distressed real estate at deeply discounted pricing. But is distress really coming? If so, when? And just how distressed will the market really get?

The answers to these questions vary depending on who you ask, and the data can be difficult to track down. However, MSCI recently released its U.S. distress tracker, making it a must-read report. Here are the key facts and figures to know.

How much distress is there today? As of the end of September, distress in the U.S. commercial real estate market climbed for a fifth consecutive quarter to a total of $79.7 billion. This figure includes both financially troubled and bank owned assets. The last time we saw these levels of distress was 2013, as the fallout from the Global Financial Crisis worked its way through property markets. However, it’s important to note the current distress level still remains less than half of what was seen during the peak of the GFC.

Where to look for distressed opportunities today:

Office: 40.8% of the total (~$32.5 billion)

Retail: 26.6% of the total (~$21.2 billion)

Hotel: 17.9% of the total (~$14.3 billion)

Where you will see less distressed opportunities today:

Industrial: 2.1% of the total (~$1.7 billion)

Other (i.e. self-storage and manufactured housing): ~3.1% of the total ($2.5 billion)

Multifamily: 9.4% of the total (~$7.5 billion)

What to watch for: MSCI warns more distress could be on the way. Specifically, they are continuing to watch the multifamily sector, where potential distress could total an estimated $65.7 billion when a wave of loans reach maturity.

Other Recommended Reads

There’s Never Been a Worse Time to Buy Instead of Rent (WSJ) While buying and renting costs typically match, today’s average monthly new mortgage payment is 52% higher than the average apartment rent. The last time there was this much imbalance was before the 2008 housing crash, and even then the premium only peaked at 33%.

Private Credit’s Lavish Profits Are Coming Under Scrutiny (Bloomberg) Private credit funds have been making record profits as a result of soaring interest rates. This has caused investors to start questioning whether the funds really deserve so much of the windfall.

Commercial-to-residential Conversion: Addressing Office Vacancies (The White House) As cities continue to struggle with climbing office vacancies and unaffordable rents, the White House released a new plan to incentivize property owners to convert empty offices into apartment buildings.